are assisted living expenses tax deductible in 2019

If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. According to the IRS any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes.

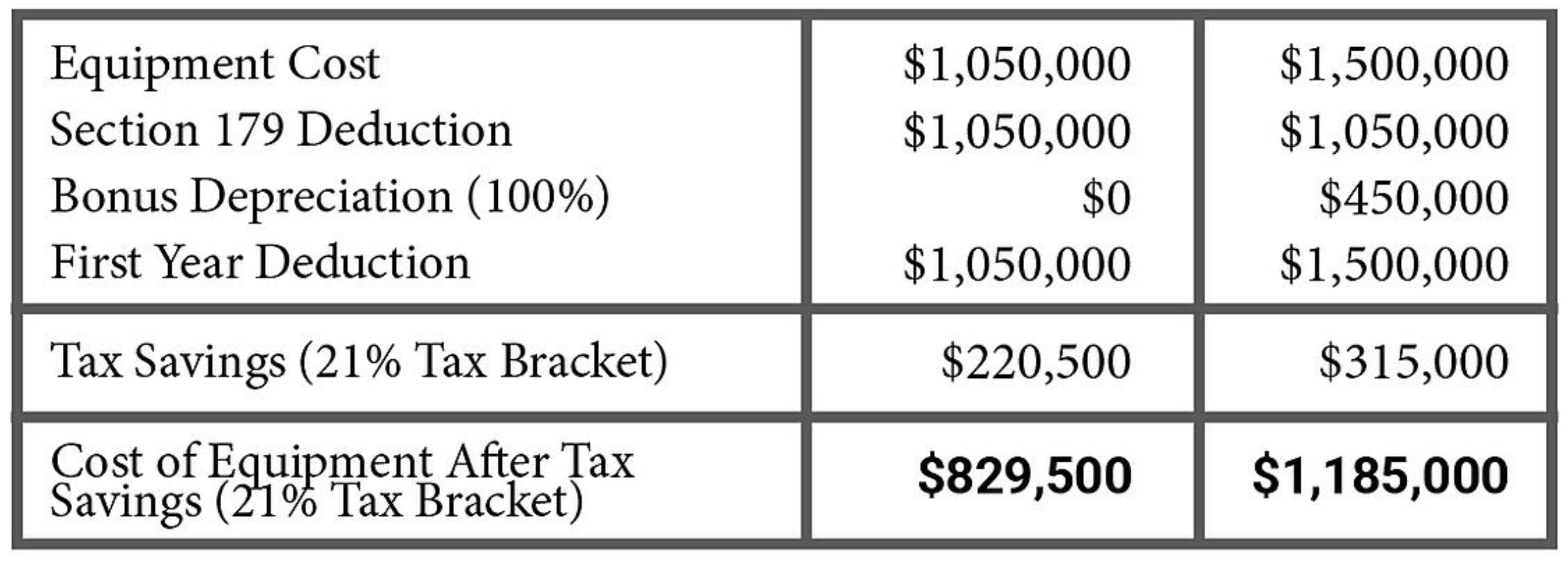

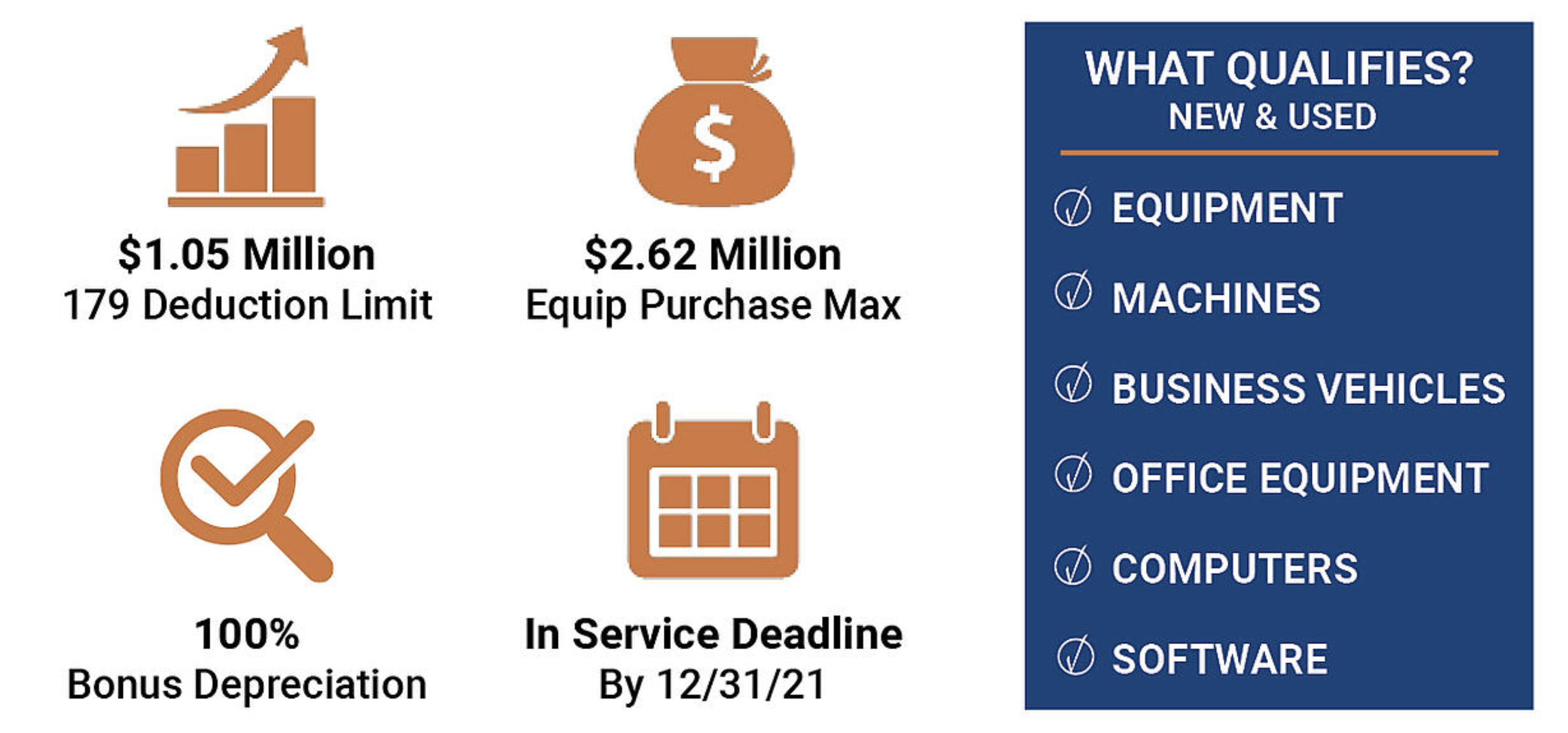

Section 179 Bonus Depreciation Saving W Business Tax Deductions Envision Capital Group

In order for assisted living expenses to be tax deductible the resident has to be considered chronically ill This means that they cannot perform two or more activities of daily living eating toileting.

. Easy Fast Secure. According to the IRS any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes. And that number is growingLong-termcarecanbeanexpensive propositionAccordingtotheUSDepartment.

If their long-term care expenses are more than 10 of your gross income as of 2019 and they are considered chronically ill these expenses are tax deductible. Obviously your own medical expenses are tax deductible and the same for your spouse and children. Is Assisted Living tax deductible IRS.

Do Your 2021 2020 any past year return online Past Tax Free to Try. Oct 29 2019 If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. Ad Free prior year federal preparation Prepare your 2019 state tax 1799.

Qualifying relatives include your siblings and their children. If that individual is in a home primarily for non-medical reasons then only. For information on claiming attendant care and the disability amount see the chart.

Yes in certain instances nursing home expenses are deductible medical expenses. You can include in medical expenses the cost of medical care in a nursing home home for the aged or similar institution for yourself your spouse or. You can also subtract the medical expenses of qualifying relatives from the final amount of taxes you need to pay.

There are special rules when claiming the disability amount and attendant care as medical expenses. Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try. To understand more about your personal tax situation and your deductions.

The medical deduction for assisted living includes all the expenses if the primary reason for living in a facility is for medical care. You can also see the examples. As we mentioned earlier in order for any of your assisted living expenses to be considered tax-deductible medical expenses they must exceed the IRSs threshold of 0075 or 75.

Long-Term Care Expenses by Donald E. Mental factors include requiring supervision for their protection. Caregivers who meet those requirements can deduct medical expenses that exceed 75 of their adjusted gross income.

Assisted Living for a Qualifying Relative. If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. To qualify for these deductions caregivers must be able to claim that senior as a dependent and be paying for at least 50 of their living expenses.

Physical factors of chronic illness include the inability to feed themselves dress bathe or get to the bathroom. Special rules when claiming the disability amount. Medical expenses including some long-term care expenses are deductible if they exceed 10 of your gross income in 2019.

Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. Calculate your net federal tax by completing Step 5 of your tax return to find out what is more beneficial for you.

So if your total medical expenses are 50000 only expenses exceeding 3750 would be eligible for a deduction. See the following from IRS Publication 502. Keith CPA There are currently more than one million individuals living in Assisted Living communities in the US.

Easy Fast Secure. Ad File State And Federal For Free With TurboTax Free Edition. In order for assisted living expenses to be tax deductible the resident must be considered chronically ill This means a doctor or nurse has certified that the resident either.

According to the IRS any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes. If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense.

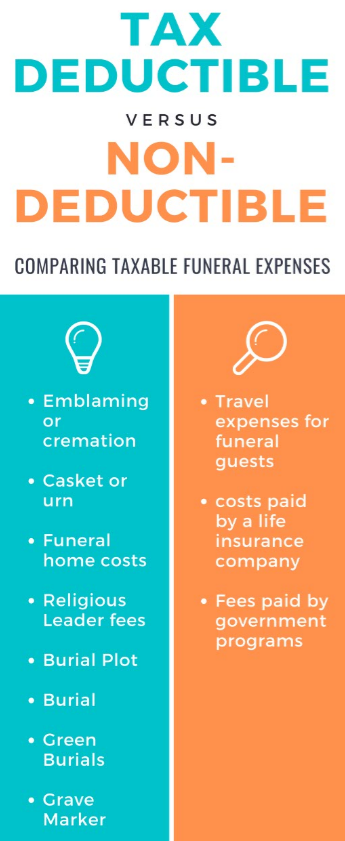

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Common Health Medical Tax Deductions For Seniors In 2022

10 Tax Deductions For Seniors You Might Not Know About

Are Assisted Living Costs Tax Deductible

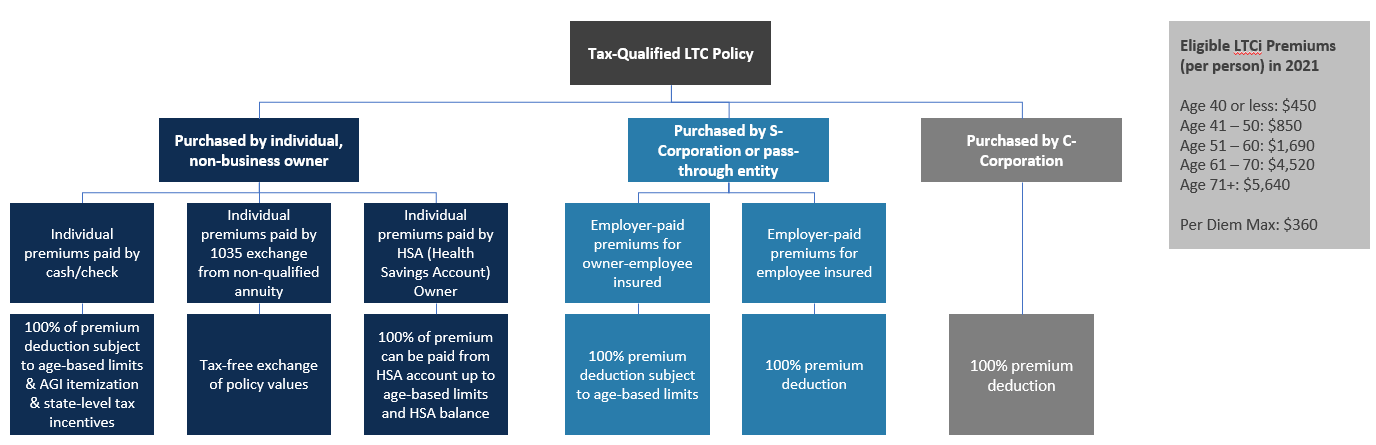

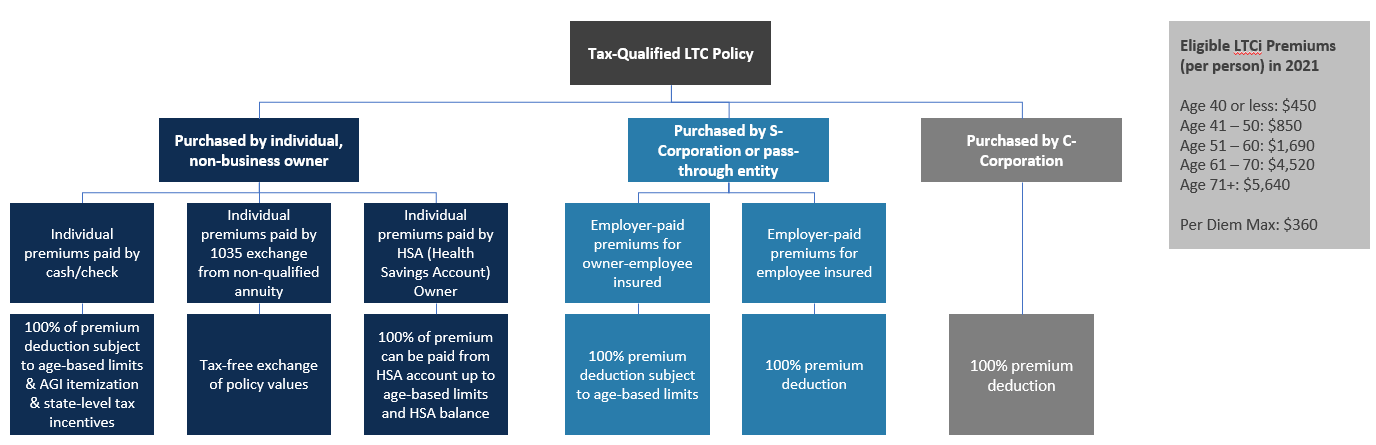

Surprising Tax Benefits Of Long Term Care Aht Insurance

Common Health Medical Tax Deductions For Seniors In 2022

Self Employed Health Insurance Deduction Healthinsurance Org

Flowcharts Fiduciary Fee Only Financial Advisor In Milwaukee Chicago Minneapolis

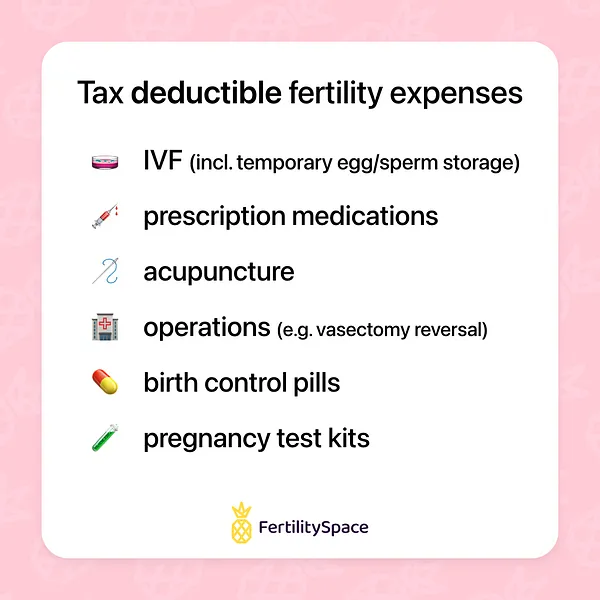

Tax Season How To Write Off Ivf On Your Taxes

Common Health Medical Tax Deductions For Seniors In 2022

How Older Adults Can Benefit From The Earned Income Tax Credit

How To Deduct Home Care Expenses On My Taxes

Private Home Care Services May Be Tax Deductible

Washington S Long Term Care Payroll Tax And How To Opt Out Alterra Advisors

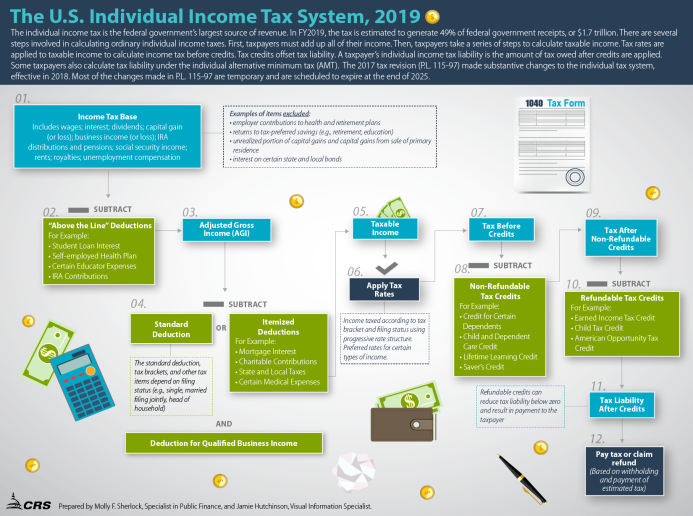

Overview Of The Federal Tax System In 2022 Everycrsreport Com

Section 179 Bonus Depreciation Saving W Business Tax Deductions Envision Capital Group

You May Be Able To Deduct Some Ccrc Costs From Your Taxes Mylifesite